A beginners guide for investing into vintage watches

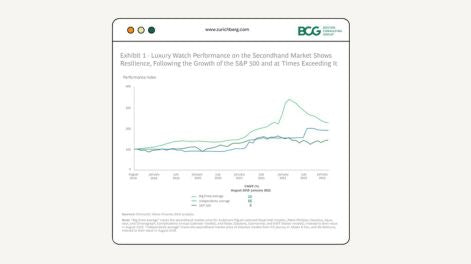

As low interest rates continue to impact low-risk investment and savings options like ISAs and Premium Bonds, many are exploring alternative investment opportunities. While cryptocurrency, index funds, and domestic share-trading platforms have received significant attention, the investment potential of wristwatches remains a topic of debate. To provide some clarity, we've created a brief guide outlining the different categories of watch investment, the key factors to consider for each, and the associated risks.

This topic has sparked a heated discussion within the watch enthusiast community, with strong opinions on both sides. Before diving in, we want to make it clear that this article is not intended to be financial advice. That being said, there are some basic guidelines to follow when buying watches. It's generally accepted that vintage watches, once they've reached the bottom of their depreciation curve and demonstrated steady growth, can be safe, reliable, and enjoyable investments. It is also associated with reduced with less personal effort as you won't for example have to pay any capital gains tax on funds earned through the appreciation of the watch while it's in your possession, unlike with property investments.

So, what makes a watch an "investment watch"? It's a timepiece that is expected to increase in tradable value over time, either for resale or as a relatively liquid asset to free up money if needed. However, not all high-value watches qualify. Antique pocket watches, diamond-covered dress watches, and heavily-patinated WW1 pilots watches may have theoretical high values, but interest may not be there when it comes time to sell. It's also important to note that great watches are not necessarily investment watches. This is particularly true for modern watches that haven't had a chance to go through their most significant period of depreciation and where the brand behind the watch isn't proven to retain its value over the long term. It can therefore be argued that vintage watches are the safest Investment among wrist jewelery due to the already proven value preservation, making it an attractive option for beginners experts alike. Especially in the current climate of reducing your carbon footprint and the evergrowing popularity and enthusiasm towards vintage watches, the latter offer a secure foundation to build up your investment activities.

Over the past 15 years, the vintage watch market has seen a significant increase in interest, evidenced by the growing number of dealers specializing in vintage watches, the proliferation of vintage watch publications such as Hodinkee, and the widespread coverage of major auction events, including the record-breaking sale of Paul Newman's Rolex Daytona in 2017. This surge of interest is in part due to the rich history associated with vintage watches, which owners often explore through research. The internet has facilitated access to information about vintage watches that was once limited to rare books, experts, and archives. Today, enthusiasts can find a wealth of knowledge on forums, videos, blogs, marketplaces, and journals, making it easier than ever to delve into the hobby. As demand for quality vintage watches outstrips supply, their value is expected to increase across the board.

Generally speaking, vintages watches can be divided into two subcategories regarding investing, these being vintage grails and vintage classics.

Vintage Grails

Vintage Grails are watches that are old enough to have gone through a depreciation slump while still being objectively rare due to low production numbers, good condition or their historical significance. Additionaly, they were generally produced by brands who continue to play a big role in today's watch industry. Essentialy, these are wristwatches whose long-term investability and market-topping prices are justified as well as secured by the great stories behind them or their brand, securing their place in horological history.

Vintage watches with rich historical significance are highly coveted by collectors, and the early series Omega Speedmasters are a prime example. While these watches were once affordable, their value has skyrocketed over the past decade, and they are now considered one of the top 5 most important watches in history. With the Calibre 321 movement, these watches can fetch anywhere from CHF80,000 to CHF200,000 at auction, depending on their condition. One advantage of investing in vintage watches from thriving manufacturers is that the current marketing and R&D efforts of top brands keep public awareness high. For instance, Omega's elaborate scanning process of the original 321 Calibre and its subsequent use in a modern Speedmaster has increased awareness and demand for the original models.

Another example of timepieces worth investing in are the double-stamped watches that showcase significant moments in the history of horology. These watches are a result of the 170-year relationship between Tiffany & Co, a heritage jeweler, and Patek Philippe. Tiffany & Co became the first retailer in America to sell Patek Philippe watches in 1851, and they have been selling a limited number of co-signed Patek watches each year since then. Recently, when 19th and 20th century Tiffany & Co-stamped Patek Philippe watches have been put up for sale, simple 3-hand Calatravas have sold for around CHF100,000, with more complicated models selling for over CHF1,000,000. These vintage watches from two respected brands that continue to allure their potential customers and maintain a high public image are certain to appreciate in value in the future.

Vintage Classics

The second subcategory is considered by many to solve the basically nonexistent wearability and high cost of entry issues thrown-up by the aforementioned rubric. Just as the latter, they are old enough to have already gone through a depreciation slump and were produced by brands still playing a large role in todays watch industry. But they are mostly eye-catchers for their classic, timeless designs that are not subject to changing style trends while still being timepieces that epitomize their respective design era. Them being in good condition is decisive, which makes long-lasting materials and reliable, widely-serviceable movements a necessity.

There are numerous examples of watches that meet the criteria for being a good investment. Brands like Omega, IWC, Jaeger-LeCoultre, Breitling, Heuer, and Zenith have all produced a variety of watches with timeless designs that are resistant to trends. These watches feature elegant dials and are sized appropriately for the average man's wrist, typically ranging from 34mm to 40mm. For a watch to be considered a "Vintage Classic," it must have been produced before 1990 to ensure stable and predictable value growth. However, the exception to this rule is Rolex watches with an Oyster case that were produced before 2009 and cost less than CHF20,000. In our opinion, these 5-digit reference models are also a good investment option when purchased in good condition. Sticking to popular brands when investing in vintage watches is a wise decision because of the added value associated with the brand's reputation when selling the watch. Moreover, the movements used by these reputable Swiss brands are still serviceable with OEM replacement parts, which ensures the watch's functionality and value in the long run.

Investing in a "Vintage Classic" watch offers several financial benefits, including reduced risk due to its trend-proof value. Instead of experiencing frequent fluctuations, you can expect steady and reliable growth without any pressure to buy or sell at specific times. This means you can own and enjoy the watch for as long as you wish. Additionally, "Vintage Classics" are typically more wearable, as their value appreciation is not solely dependent on their condition. This is evidenced by the fact that many of these watches are available at affordable prices, particularly in comparison to "Vintage Grails." For instance, 60s, 70s, and 80s Omega Seamasters in Yellow Gold can be found for under CHF4,000, while steel, 3-hander IWC, Rolex Oyster, and JLC watches are available for around CHF3,000.

Leave a comment